Introduction

Traveling with your furry companion can be an enriching experience, but it also comes with its fair share of worries. From vet bills to lost luggage, unexpected events can quickly turn a dream vacation into a stressful ordeal. That’s where pet travel insurance comes in.

Tuft & Paw is a leading provider of pet travel insurance, offering comprehensive coverage to protect your beloved pet during their adventures. But how does it stack up against its competitors? Let’s explore the benefits and drawbacks of Tuft & Paw’s travel insurance offerings in 2025 and beyond.

Comprehensive Coverage: Paw-tection for Every Adventure

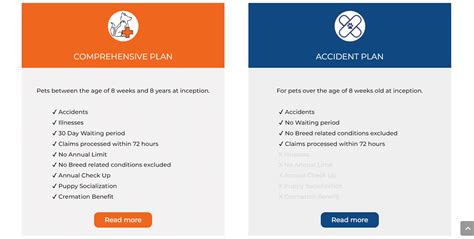

Tuft & Paw’s travel insurance covers a wide range of expenses and incidents that can occur while traveling with your pet:

- Medical expenses: Up to $30,000 in coverage for unexpected vet bills, injuries, and illnesses.

- Emergency boarding: Reimbursement for boarding costs incurred if you need to leave your pet alone due to an emergency.

- Lost or stolen luggage: Protection for your pet’s belongings, including luggage, carriers, and travel documents.

- Trip cancellation or interruption: Compensation for prepaid travel expenses if your trip is canceled or interrupted due to a covered event.

- Death and burial: Coverage for funeral expenses and pet replacement costs in the event of your pet’s untimely demise.

Affordability and Value: Tailored to Your Pocketbook

Tuft & Paw’s travel insurance plans start at $25 per month, offering tailored coverage options to suit different budgets and needs. The premium is calculated based on the pet’s age, breed, and health history.

Cost Comparison Table:

| Provider | Monthly Premium (Average) |

|---|---|

| Tuft & Paw | $25-$50 |

| Pumpkin | $30-$60 |

| PetPlan | $40-$70 |

Comparison: Paw-by-Paw Analysis

Let’s compare Tuft & Paw’s travel insurance to two of its main competitors, Pumpkin and PetPlan:

Coverage Comparison Table:

| Feature | Tuft & Paw | Pumpkin | PetPlan |

|---|---|---|---|

| Medical expenses | Up to $30,000 | Up to $10,000 | Up to $25,000 |

| Emergency boarding | Yes | Yes | No |

| Lost or stolen luggage | Yes | Yes | Yes |

| Trip cancellation or interruption | Yes | Yes | Yes |

| Death and burial | Yes | Yes | No |

Affordability Comparison:

As mentioned earlier, Tuft & Paw’s monthly premiums start at $25. Pumpkin offers slightly higher premiums, starting at $30 per month. PetPlan’s premiums are typically the highest, starting at $40 per month.

Customer Service Comparison:

Tuft & Paw, Pumpkin, and PetPlan all boast high customer satisfaction ratings and offer 24/7 support. However, customer reviews suggest that Tuft & Paw may have a slight edge in terms of responsiveness and claim processing time.

Tips and Tricks: Maximizing Your Coverage

To make the most of your Tuft & Paw travel insurance, consider the following tips:

- Purchase coverage early: Secure your policy well before your departure to ensure your pet is fully protected.

- Enroll in the loyalty program: Tuft & Paw offers a loyalty program that rewards repeat customers with discounts and perks.

- Keep a detailed record of expenses: Document all vet bills and other expenses related to your trip for easy reimbursement.

- File claims promptly: Submit claims as soon as possible after an incident to minimize delays in processing.

Standout Features: Blazing the Trail for Pet Travel Insurance

Tuft & Paw sets itself apart from its competitors with several innovative features:

- Unlimited per-incident coverage: Unlike some other providers, Tuft & Paw does not limit coverage per incident, providing peace of mind in the event of major medical emergencies.

- No hidden fees: Tuft & Paw’s policies are transparent and straightforward, with no surprise fees or hidden deductibles.

- Online claims submission: Submit claims easily and conveniently through Tuft & Paw’s online portal.

- 24/7 veterinary hotline: Access to licensed veterinarians for advice and support during your trip.

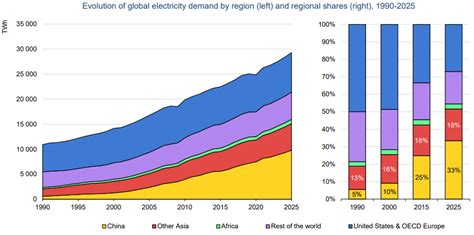

Market Insights: Paw-inting the Future of Pet Travel Insurance

The pet travel insurance market is projected to grow significantly in the coming years, driven by rising pet ownership and increased travel frequency. Tuft & Paw is well-positioned to capture a large share of this market by:

- Expanding its offerings: Introducing additional coverage options and services to cater to the evolving needs of pet owners.

- Investing in technology: Enhancing its online platform, mobile app, and claims processing to provide a seamless customer experience.

- Forming strategic partnerships: Collaborating with travel agencies, pet care providers, and pet adoption organizations to increase its reach and visibility.

Conclusion

Tuft & Paw Travel Insurance is a paw-some choice for protecting your furry companion on their adventures. With comprehensive coverage, affordable premiums, and innovative features, it stands out as a leader in the pet travel insurance market. Whether you’re planning a weekend road trip or an exotic overseas getaway, Tuft & Paw’s got you and your pet covered.

Pros:

- Comprehensive coverage for a wide range of events

- Affordable premiums tailored to different budgets

- Excellent customer service and claim processing

- Innovative features such as unlimited per-incident coverage and 24/7 veterinary hotline

- Strong market position and growth potential

Cons:

- Coverage limits may be insufficient for some veterinary expenses

- May not cover all pre-existing conditions

- Not available in all countries