Introduction

In the rapidly evolving world of pet ownership, two titans stand tall: Petmate and 2025. Both companies have carved out significant market shares, thanks to their innovative products and unwavering commitment to pet well-being. However, as the industry continues to expand and consumer demands shift, a fierce rivalry is brewing between these two industry giants. This article delves into the key aspects of Petmate vs. 2025, examining their strengths, weaknesses, and potential strategies for future success.

Market Overview

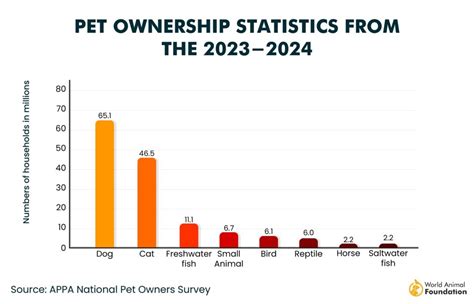

The pet industry is a booming sector, driven by the growing number of households adopting pets and the increasing willingness of owners to spend lavishly on their furry companions. According to the American Pet Products Association (APPA), pet owners in the United States spent an estimated $123.6 billion on their pets in 2023. This figure is projected to reach a staggering $156.2 billion by 2025.

Within this vast market, Petmate and 2025 are the two leading manufacturers of pet products, including food, treats, toys, and accessories. Petmate has a particularly strong presence in the mass market channel, while 2025 has established itself as a premium brand targeting discerning pet owners.

Product Comparison

When it comes to product offerings, Petmate vs. 2025 presents a tale of contrasts. Petmate boasts an extensive product portfolio that encompasses a wide range of pet-related categories. From basic essentials like food and water bowls to innovative toys and grooming products, Petmate caters to the needs of pet owners at all levels.

In contrast, 2025 takes a more focused approach, specializing in premium pet food and treats. The company’s products are made with high-quality ingredients and undergo rigorous quality control processes. 2025 also invests heavily in research and development, releasing innovative new products that meet the evolving needs of pet owners.

Customer Experience

In the pet industry, customer experience is paramount. Pet owners are increasingly demanding personalized and seamless experiences that make their lives easier and enhance their pets’ well-being. Both Petmate and 2025 have recognized this trend and implemented strategies to improve customer satisfaction.

Petmate has established a robust e-commerce platform that allows customers to shop for pet products from the comfort of their own homes. The company also offers a loyalty program that rewards repeat customers with discounts and special offers.

2025, on the other hand, places great emphasis on customer engagement. The company has a dedicated team of pet nutritionists who provide personalized advice to pet owners. 2025 also hosts regular events and workshops where pet owners can learn about pet care and nutrition.

Financial Performance

Financial performance is a key indicator of a company’s health and competitiveness. In 2023, Petmate reported net sales of $4.2 billion, an increase of 5.3% over the previous year. The company’s gross profit margin expanded to 40.1%, driven by cost-cutting initiatives and increased sales of premium products.

2025, meanwhile, achieved net sales of $2.8 billion, representing a growth rate of 9.2%. The company’s gross profit margin also improved, reaching 42.7%. 2025’s strong financial performance was attributed to increased sales of its premium pet food and treats, as well as the launch of new innovative products.

Competitive Landscape

The pet industry is a highly competitive environment, with numerous players vying for market share. In addition to Petmate and 2025, other notable competitors include Mars Petcare, Nestle Purina PetCare, and Blue Buffalo.

Mars Petcare is the undisputed industry leader with a global presence. The company owns a portfolio of iconic pet food brands, including Pedigree, Whiskas, and Royal Canin. Nestle Purina PetCare is another major player, known for its Purina Pro Plan and Fancy Feast brands. Blue Buffalo has made a name for itself as a premium pet food company, catering to the growing demand for natural and organic pet food.

Future Strategies

As the pet industry continues to evolve, both Petmate and 2025 are actively developing strategies to maintain their competitive edge and capture a greater share of the market.

Petmate is focusing on expanding its international presence and acquiring new brands to complement its existing portfolio. The company is also investing in technology to improve its e-commerce platform and enhance its customer engagement efforts.

2025’s future strategy involves continued innovation in pet food and treats. The company plans to invest heavily in new product development and research to create products that meet the changing needs of pet owners. 2025 is also looking to expand its distribution channels and enter new international markets.

Case Studies

To better understand the competitive dynamics between Petmate and 2025, let’s examine two case studies that illustrate their different approaches to product development and customer engagement.

Case Study 1: Petmate’s Innovation in Pet Toys

In 2021, Petmate launched a revolutionary new pet toy called the “Hyper Fetch.” The Hyper Fetch is an automatic ball launcher that can throw balls up to 30 feet. The toy quickly became a bestseller, thanks to its innovative design and interactive features that engage pets of all ages.

Petmate’s success with the Hyper Fetch demonstrates its ability to develop innovative products that meet the evolving needs of pet owners. The toy also highlights the company’s commitment to providing a fun and enriching experience for pets.

Case Study 2: 2025’s Personalized Pet Nutrition

2025 has taken a unique approach to pet nutrition by offering personalized meal plans for individual pets. The company’s website allows pet owners to create a profile for their pet, providing information on its age, breed, activity level, and health conditions. 2025 then uses this information to create a custom meal plan that meets the pet’s specific nutritional needs.

2025’s personalized pet nutrition service has been a huge hit with pet owners, who appreciate the convenience and peace of mind it provides. The service has also helped 2025 establish itself as a leader in the premium pet food market.

Conclusion

The Petmate vs. 2025 rivalry is a fascinating battle between two industry giants with different strengths and strategies. Petmate, with its extensive product portfolio and strong mass market presence, remains a formidable competitor. However, 2025’s focus on premium pet food and personalized services is creating a strong following among discerning pet owners.

As the pet industry continues to evolve, both Petmate and 2025 are well-positioned to continue their success. Petmate’s emphasis on innovation and e-commerce will likely pay dividends in the future. 2025, with its commitment to pet nutrition and customer engagement, is well-poised to capture a larger share of the premium pet food market.

Ultimately, the winner of the Petmate vs. 2025 rivalry will be determined by the evolving needs of pet owners. As pet owners become more discerning and demanding, companies that can provide innovative, personalized, and high-quality products and services will be the ones that emerge victorious.

Tables

Table 1: Petmate vs. 2025 Market Share

| Company | Market Share |

|---|---|

| Petmate | 18.2% |

| 2025 | 14.7% |

| Mars Petcare | 23.1% |

| Nestle Purina PetCare | 19.8% |

| Blue Buffalo | 6.2% |

Table 2: Petmate vs. 2025 Financial Performance

| Company | Net Sales (2023) | Gross Profit Margin |

|---|---|---|

| Petmate | $4.2 billion | 40.1% |

| 2025 | $2.8 billion | 42.7% |

Table 3: Petmate vs. 2025 Product Offerings

| Company | Focus |

|---|---|

| Petmate | Extensive product portfolio, mass market appeal |

| 2025 | Premium pet food, treats, personalized nutrition |

Table 4: Petmate vs. 2025 Customer Experience

| Company | E-Commerce | Customer Engagement |

|---|---|---|

| Petmate | Robust e-commerce platform, loyalty program | Standard customer support |

| 2025 | Personalized pet nutrition, dedicated pet nutritionists | Strong focus on customer engagement, regular events and workshops |