Introduction

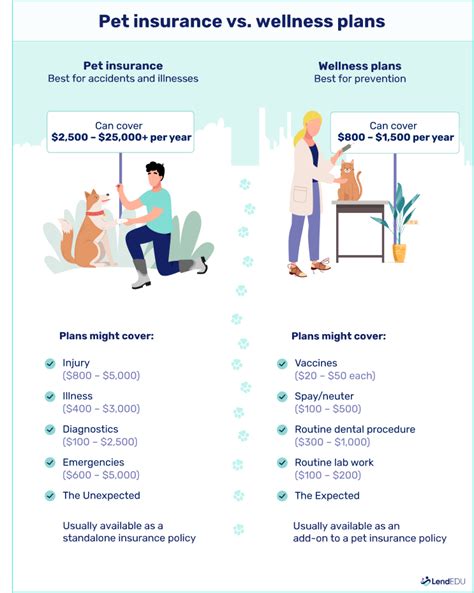

As a responsible pet owner, ensuring your furry companion’s well-being is paramount. While pet health insurance and wellness plans offer coverage for various expenses, understanding the key differences will help you make an informed decision. This comprehensive guide will compare and contrast these options to determine which aligns best with your needs.

Section 1: Pet Wellness Plans

Definition:

Pet wellness plans are preventative care packages offered by veterinary clinics or third-party providers. They typically include routine services such as:

- Annual checkups

- Vaccinations

- Deworming

- Dental cleanings

- Bloodwork

- Urine analysis

Benefits:

- Discounted services: Plans offer a pre-negotiated price for routine care, potentially saving you money compared to paying for each service individually.

- Convenience: Regular appointments and reminders help ensure your pet’s health is consistently monitored.

- Transparency: Known costs provide peace of mind and allow for budgeting.

Drawbacks:

- Limited coverage: Does not cover unexpected injuries, illnesses, or emergency expenses.

- Pre-existing conditions: May not cover conditions that existed before enrolling in the plan.

- Yearly limitations: Most plans have a limit on the number of times services can be used per year.

Section 2: Pet Health Insurance

Definition:

Pet health insurance is a policy that reimburses pet owners for covered medical expenses, including:

- Veterinary visits

- Diagnostics

- Surgeries

- Medications

- Hospitalization

Benefits:

- Financial protection: Provides a safety net against unpredictable veterinary expenses.

- Wide coverage: Usually covers a range of accidents, illnesses, and treatments.

- Peace of mind: Knowing you have a financial cushion in case of an emergency.

Drawbacks:

- Premiums: Monthly or annual costs can be higher than wellness plans.

- Deductibles and copays: Typically requires a deductible payment and a percentage of the remaining expenses.

- Exclusions: Some policies exclude pre-existing conditions, elective procedures, or specific breeds.

Comparison Table 1: Coverage

| Feature | Pet Wellness Plans | Pet Health Insurance |

|---|---|---|

| Routine care | Included (discounted) | Not covered |

| Accidents | Not covered | Typically covered |

| Illnesses | Not covered | Typically covered |

| Surgeries | Not covered | Typically covered |

| Dental care | May be included (limited) | Usually covered (up to a limit) |

Comparison Table 2: Costs

| Feature | Pet Wellness Plans | Pet Health Insurance |

|---|---|---|

| Upfront cost | Monthly/annual subscription | Premiums, deductibles, copays |

| Annual costs | $100-$500 (approx.) | Variable based on plan and pet’s health |

| Savings potential | Can save money on routine care | Depends on the frequency and cost of medical expenses |

Decision Factors

Whether a pet wellness plan or insurance is right for you depends on factors such as:

- Your pet’s age and health: If your pet is young and healthy, a wellness plan may be sufficient. If older or with pre-existing conditions, insurance may provide greater protection.

- Your financial situation: Wellness plans offer a known cost, while insurance premiums can vary. Consider your ability to cover unexpected expenses.

- Your lifestyle: Insurance is essential if your pet is active and prone to accidents. If you prefer regular monitoring, a wellness plan may suit your needs.

Reviews

Review 1: “My wellness plan has saved me hundreds on routine care for my healthy beagle. I know I’m not covered for emergencies, but I’m comfortable with that risk for the savings I get.” – Sarah J.

Review 2: “After our golden retriever had a sudden illness, we realized insurance was crucial. They covered most of the expenses and gave us peace of mind that we wouldn’t have to sacrifice care due to cost.” – John K.

Review 3: “I chose a wellness plan because I want to prioritize preventative care for my kitten. It’s worth the small monthly cost to ensure she gets the best possible start.” – Emily B.

Review 4: “Insurance gives me the confidence that my dog is protected if anything unexpected happens. I’ve been able to afford necessary surgeries and treatments without breaking the bank.” – David H.

Current Status and Future Trends

The pet healthcare industry is growing rapidly, with both wellness plans and insurance playing significant roles. The demand for affordable preventative care has driven the popularity of wellness plans, especially for younger and healthy pets. At the same time, increased pet adoption and awareness of pet health has led to more pet owners seeking insurance coverage for emergencies.

Conclusion

Choosing between pet wellness plans and insurance is a personal decision. By understanding the key differences, costs, and benefits, you can make an informed choice that aligns with your pet’s needs and your financial circumstances. Remember, the goal is to ensure your furry companion receives the best possible care, giving you peace of mind and a long, happy life together.