Introduction

The decision of whether to obtain pet insurance can be a complex one for pet owners. On the one hand, pet insurance can provide peace of mind and financial protection against unexpected veterinary expenses. On the other hand, pet insurance can be expensive, and there are many factors to consider when choosing a policy. This guide will provide an overview of pet insurance, including the different types of coverage available, the benefits of pet insurance, and the factors to consider when choosing a policy.

Types of Pet Insurance

There are two main types of pet insurance: accident-only insurance and comprehensive insurance. Accident-only insurance covers only veterinary expenses that result from an accident, such as a broken bone or a laceration. Comprehensive insurance covers a wider range of veterinary expenses, including both accidents and illnesses.

Benefits of Pet Insurance

There are a number of benefits to pet insurance, including:

- Financial protection: Pet insurance can provide financial protection against unexpected veterinary expenses. Veterinary care can be expensive, and pet insurance can help to offset the cost of unexpected treatments.

- Peace of mind: Pet insurance can provide peace of mind by knowing that you are financially prepared to cover your pet’s veterinary expenses.

- Access to better care: Pet insurance can provide access to better veterinary care by allowing you to choose the best treatment options for your pet without worrying about the cost.

Factors to Consider When Choosing a Pet Insurance Policy

There are a number of factors to consider when choosing a pet insurance policy, including:

- Coverage: The type of coverage you need will depend on your pet’s age, health, and lifestyle. If your pet is young and healthy, you may only need accident-only insurance. If your pet is older or has a history of health problems, you may need comprehensive insurance.

- Premium: The premium for pet insurance will vary depending on the type of coverage you choose, the age of your pet, and the breed of your pet. You should compare quotes from multiple insurance companies to find the best rate.

- Deductible: The deductible is the amount you will have to pay out of pocket before your insurance policy starts to cover veterinary expenses. You should choose a deductible that you can afford to pay.

- Coinsurance: Coinsurance is the percentage of veterinary expenses that you will have to pay after you have met your deductible. You should choose a coinsurance percentage that you are comfortable with.

- Claim process: The claim process is the process by which you submit a claim to your insurance company. You should choose an insurance company with a simple and easy-to-understand claim process.

Common Mistakes to Avoid When Choosing a Pet Insurance Policy

There are a number of common mistakes that pet owners make when choosing a pet insurance policy, including:

- Choosing the wrong type of coverage: Choosing the wrong type of coverage can result in you not having the coverage you need when you need it. Make sure to choose a policy that provides the type of coverage you need for your pet.

- Not comparing quotes: Not comparing quotes from multiple insurance companies can result in you paying more for your pet insurance than you need to. Make sure to compare quotes from multiple insurance companies to find the best rate.

- Choosing a high deductible: Choosing a high deductible can result in you having to pay more out of pocket for veterinary expenses. Choose a deductible that you can afford to pay.

- Choosing a high coinsurance percentage: Choosing a high coinsurance percentage can result in you having to pay more out of pocket for veterinary expenses. Choose a coinsurance percentage that you are comfortable with.

- Not reading the policy carefully: Not reading the policy carefully can result in you not understanding the coverage that you are purchasing. Make sure to read the policy carefully before you purchase it.

Tips for Choosing the Right Pet Insurance Policy

Here are a few tips for choosing the right pet insurance policy:

- Start by comparing quotes from multiple insurance companies. This will help you find the best rate on the coverage you need.

- Choose a policy that provides the type of coverage you need for your pet. If your pet is young and healthy, you may only need accident-only insurance. If your pet is older or has a history of health problems, you may need comprehensive insurance.

- Choose a deductible that you can afford to pay. The deductible is the amount you will have to pay out of pocket before your insurance policy starts to cover veterinary expenses.

- Choose a coinsurance percentage that you are comfortable with. The coinsurance percentage is the percentage of veterinary expenses that you will have to pay after you have met your deductible.

- Read the policy carefully before you purchase it. This will help you understand the coverage that you are purchasing.

Conclusion

Pet insurance can be a valuable tool for pet owners. It can provide financial protection against unexpected veterinary expenses, peace of mind, and access to better care. However, it is important to choose a policy that is right for you and your pet. By following the tips in this guide, you can choose the right pet insurance policy for your needs.

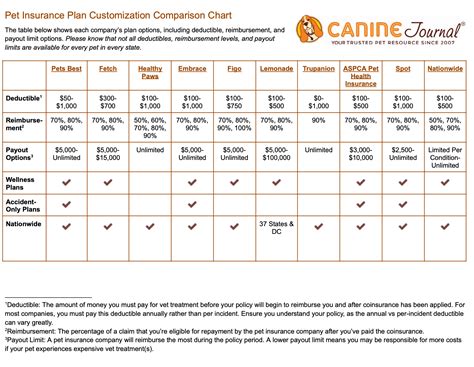

Table 1: Comparison of Pet Insurance Companies

| Company | Monthly Premium | Coverage | Deductible | Coinsurance |

|---|---|---|---|---|

| Trupanion | $40-$100 | Comprehensive | $0-$1,000 | 0%-20% |

| Embrace | $30-$70 | Comprehensive | $250-$1,000 | 10%-30% |

| Healthy Paws | $35-$80 | Comprehensive | $250-$1,000 | 10%-30% |

| Figo | $25-$50 | Accident-only | $50-$250 | 0%-20% |

| Spot | $20-$40 | Accident-only | $100-$500 | 0%-20% |

Table 2: Benefits of Pet Insurance

| Benefit | Description |

|---|---|

| Financial protection | Pet insurance can provide financial protection against unexpected veterinary expenses. |

| Peace of mind | Pet insurance can provide peace of mind by knowing that you are financially prepared to cover your pet’s veterinary expenses. |

| Access to better care | Pet insurance can provide access to better veterinary care by allowing you to choose the best treatment options for your pet without worrying about the cost. |

Table 3: Factors to Consider When Choosing a Pet Insurance Policy

| Factor | Description |

|---|---|

| Coverage | The type of coverage you need will depend on your pet’s age, health, and lifestyle. |

| Premium | The premium for pet insurance will vary depending on the type of coverage you choose, the age of your pet, and the breed of your pet. |

| Deductible | The deductible is the amount you will have to pay out of pocket before your insurance policy starts to cover veterinary expenses. |

| Coinsurance | Coinsurance is the percentage of veterinary expenses that you will have to pay after you have met your deductible. |

| Claim process | The claim process is the process by which you submit a claim to your insurance company. |

Table 4: Common Mistakes to Avoid When Choosing a Pet Insurance Policy

| Mistake | Description |

|---|---|

| Choosing the wrong type of coverage | Choosing the wrong type of coverage can result in you not having the coverage you need when you need it. |

| Not comparing quotes | Not comparing quotes from multiple insurance companies can result in you paying more for your pet insurance than you need to. |

| Choosing a high deductible | Choosing a high deductible can result in you having to pay more out of pocket for veterinary expenses. |

| Choosing a high coinsurance percentage | Choosing a high coinsurance percentage can result in you having to pay more out of pocket for veterinary expenses. |

| Not reading the policy carefully | Not reading the policy carefully can result in you not understanding the coverage that you are purchasing. |

Reviews

- Trupanion: Trupanion is one of the most popular pet insurance companies in the United States. They offer a wide range of coverage options, including accident-only insurance, comprehensive insurance, and wellness coverage. Trupanion has a reputation for excellent customer service and a fast claims process.

- Embrace: Embrace is another popular pet insurance company in the United States. They offer a wide range of coverage options, including accident-only insurance, comprehensive insurance, and wellness coverage. Embrace has a reputation for excellent customer service and a fast claims process.

- Healthy Paws: Healthy Paws is a pet insurance company that is known for its affordable rates and comprehensive coverage. Healthy Paws offers a wide range of coverage options, including accident-only insurance, comprehensive insurance, and wellness coverage. Healthy Paws has a reputation for excellent customer service and a fast claims process.

- Figo: Figo is a pet insurance company that is known for its affordable rates and simple claims process. Figo offers a wide range of coverage options, including accident-only insurance, comprehensive insurance, and wellness coverage. Figo has a reputation for excellent customer service and a fast claims process.

- Spot: Spot is a pet insurance company that is known for its affordable rates and simple claims process. Spot offers a wide range of coverage options, including accident-only insurance, comprehensive insurance, and wellness coverage. Spot has a reputation for excellent customer service and a fast claims process.

Highlights

- Pet insurance can provide financial protection against unexpected veterinary expenses.

- Pet insurance can provide peace of mind by knowing that you are financially prepared to cover your pet’s veterinary expenses.

- Pet insurance can provide access