Introduction

As pet ownership continues to surge, pet insurance has emerged as a valuable tool for safeguarding the financial well-being of animal lovers. This article delves into the myriad benefits and potential drawbacks associated with pet insurance, providing a comprehensive overview to help pet owners make informed decisions about their furry companions’ healthcare.

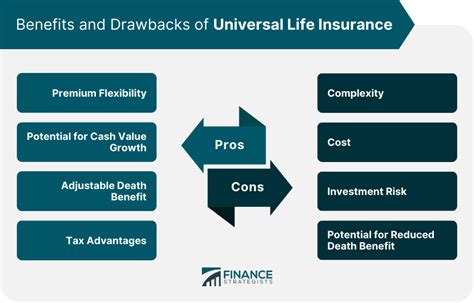

Benefits of Pet Insurance

-

Peace of Mind: Pet insurance offers peace of mind knowing that your pet’s unexpected medical expenses are covered, relieving the financial burden of veterinary bills.

-

Comprehensive Coverage: Policies typically cover a wide range of expenses, including accidents, illnesses, surgeries, hospitalizations, and diagnostics, providing comprehensive protection for your pet’s health.

-

Emergency Care: Pet insurance can cover emergency veterinary care, reducing the stress and financial strain associated with unexpected accidents or sudden illnesses.

-

Unexpected Expenses: Insurance policies help cover unexpected veterinary expenses that can arise from accidents, illnesses, or other unforeseen circumstances.

-

Long-Term Care: Some pet insurance policies offer long-term care coverage, providing financial assistance for chronic conditions and age-related ailments.

Drawbacks of Pet Insurance

-

Monthly Premiums: Pet insurance requires monthly premiums, which can add to the overall cost of pet ownership.

-

Deductibles and Co-payments: Most pet insurance policies have deductibles (the amount you pay before coverage kicks in) and co-payments (a percentage of the covered expenses you pay out-of-pocket).

-

Exclusions and Limitations: Pet insurance policies may have certain exclusions or limitations, such as pre-existing conditions or specific breeds.

-

Complexity: Understanding the terms and conditions of pet insurance policies can be complex and confusing, requiring careful consideration before purchasing.

Comparison of Benefits and Drawbacks

| Benefit | Drawback |

|---|---|

| Peace of mind | Monthly premiums |

| Comprehensive coverage | Deductibles and co-payments |

| Emergency care | Exclusions and limitations |

| Unexpected expenses | Complexity |

| Long-term care |

Effective Strategies for Choosing Pet Insurance

-

Research and Compare Policies: Explore different pet insurance providers and policies, comparing coverage, premiums, and exclusions to find the best fit for your needs.

-

Consider Your Budget: Determine how much you can afford to spend on monthly premiums and deductibles.

-

Factors to Consider: Age, breed, health, and lifestyle of your pet, as well as the potential for future medical expenses, should all be taken into account when choosing a policy.

-

Read the Fine Print: Carefully review the terms and conditions of any pet insurance policy you consider, paying attention to exclusions, limitations, and any potential loopholes.

-

Choose a Reputable Provider: Select an insurance company with a good reputation for customer service and claims processing.

Tips and Tricks for Pet Insurance

-

Start Early: Insuring your pet at a young age can result in lower premiums.

-

Enroll Healthy Pets: Insuring pets when they are healthy can prevent pre-existing condition exclusions.

-

Consider Wellness Coverage: Some policies offer wellness coverage for preventive care, such as vaccinations and dental cleanings.

-

Review Regularly: Periodically review your pet insurance policy to ensure it still meets your needs and consider adjusting it as necessary.

Common Mistakes to Avoid

-

Underestimating Medical Costs: Vet bills can be expensive, so don’t underestimate the potential costs of pet care.

-

Choosing the Wrong Coverage: Ensure the policy covers the types of medical expenses you need it to.

-

Not Shopping Around: Compare policies and premiums from different providers to find the best deal.

-

Missing Out on Wellness Coverage: Wellness coverage can help save money on preventive care and long-term health costs.

Reviews of Pet Insurance Providers

-

Trupanion: Trupanion offers comprehensive coverage with low deductibles and no caps on annual payouts.

-

Nationwide: Nationwide provides a wide range of plans and offers discounts for multiple pets.

-

Embrace: Embrace offers customized policies with flexible coverage options and seamless claims processing.

-

Pets Best: Pets Best has a high approval rating and offers policies tailored to specific pet breeds and ages.

Highlights and How to Stand Out

Highlights:

- Top-rated pet insurance providers offer comprehensive coverage with low deductibles and high annual payout limits.

- Pet insurance can provide peace of mind and financial protection for unexpected veterinary expenses.

- Wellness coverage is available to help offset the costs of preventive care.

How to Stand Out:

- Pet insurance can be a valuable investment in your pet’s health and well-being.

- By researching and comparing policies, you can find the best coverage for your needs at an affordable price.

- Consider wellness coverage to help keep your pet healthy and reduce future medical expenses.