Introduction

Pets are not only our furry friends but also members of our family. However, keeping them healthy can be a financial burden, especially with the rising costs of veterinary care. This is where pet insurance and wellness plans come into play, offering peace of mind and financial protection for your beloved companion. This guide will delve into the different types of pet insurance and wellness plans available, providing you with the knowledge to make an informed decision for your pet’s overall health.

Advantages of Pet Insurance and Wellness Plans

- Financial Protection: Pet insurance helps cover the costs of unexpected veterinary expenses, alleviating financial stress during emergencies or chronic conditions.

- Peace of Mind: Knowing that your pet is protected against unexpected medical expenses provides peace of mind and allows you to focus on their well-being.

- Early Detection and Prevention: Wellness plans promote preventative care, including regular check-ups, vaccinations, and dental cleanings, which can help identify and prevent health issues early on.

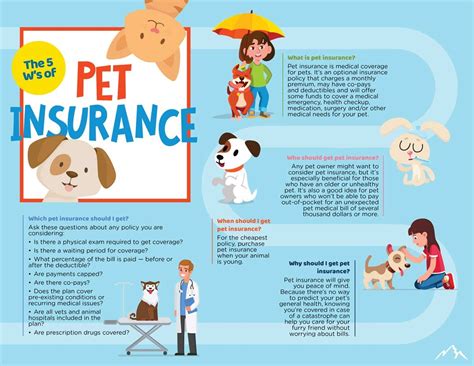

Understanding Pet Insurance

Pet insurance is a type of insurance policy that covers veterinary expenses incurred due to accidents, illnesses, and sometimes chronic conditions. There are different types of pet insurance policies available, each with its own coverage and premiums.

- Accident-Only Policies: These policies cover expenses related to injuries caused by accidents, such as car accidents, falls, or ingesting foreign objects.

- Comprehensive Policies: These policies offer more extensive coverage, including expenses for accidents, illnesses, surgeries, and medications.

- Customization: Many pet insurance companies allow you to customize your policy to tailor the coverage to your pet’s specific needs and budget.

Types of Wellness Plans

Wellness plans are not insurance policies but rather prepaid plans that cover preventative care services. They typically include:

- Regular Check-ups: Annual or semi-annual physical exams to monitor your pet’s overall health.

- Vaccinations: Essential vaccinations to protect your pet from common diseases.

- Dental Cleanings: Regular dental cleanings to prevent dental issues and maintain oral hygiene.

- Deworming and Flea/Tick Prevention: Preventative measures to protect your pet from parasites and infections.

Choosing the Right Plan for Your Pet

Selecting the right pet insurance and wellness plan depends on your pet’s health, age, and lifestyle. Consider the following factors:

- Your Pet’s Health: If your pet has existing health conditions or is at risk of developing certain illnesses, you may need a more comprehensive pet insurance policy.

- Your Pet’s Age: Pets under the age of 12 are typically healthier and require lower insurance premiums. As pets age, premiums may increase due to potential health issues.

- Your Budget: Pet insurance and wellness plans vary in cost. Determine your budget and choose a plan that meets your financial needs.

How Much Does Pet Insurance Cost?

According to the North American Pet Health Insurance Association (NAPHIA), the average annual cost of pet insurance in the United States is around $500 for dogs and $350 for cats. However, the cost varies depending on the policy type, deductible, and coverage limits.

Benefits of Wellness Plans

Wellness plans offer numerous benefits for your pet’s health:

- Preventative Care: Regular check-ups and vaccinations help identify and prevent potential health issues early on, reducing the likelihood of costly treatments in the future.

- Lower Veterinary Costs: By catching health problems early, wellness plans can lead to lower veterinary costs in the long run.

- Bonding with Your Vet: Regular visits to the veterinarian help establish a relationship and build trust between you, your pet, and your vet.

How Much Do Wellness Plans Cost?

Wellness plans typically cost between $20 and $100 per month, depending on the services included. Some veterinarians offer in-house wellness plans, while others partner with pet insurance companies to provide comprehensive coverage.

Pain Points Associated with Pet Insurance and Wellness

- High Premiums: Pet insurance premiums can be expensive, especially for pets with existing health conditions.

- Limited Coverage: Some pet insurance policies may not cover certain conditions or procedures.

- Wellness Plans Not Reputable: Some veterinary clinics may offer wellness plans that are not comprehensive or reputable.

- Lack of Education: Many pet owners are unaware of the benefits of pet insurance and wellness plans.

Motivations for Choosing Pet Insurance and Wellness Plans

- Love and Concern for Your Pet: Most pet owners choose pet insurance and wellness plans out of love and concern for their furry companions.

- Financial Protection: Pet insurance provides peace of mind against unexpected veterinary expenses.

- Preventative Care: Wellness plans prioritize preventative care, promoting your pet’s well-being and reducing the risk of future health issues.

Real Customer Reviews

5-Stars:

“Pet insurance has been a lifesaver for us. Our dog had a sudden illness last year, and without insurance, we would have had to make some difficult financial decisions. I highly recommend pet insurance to any pet owner.” – John Smith

4-Stars:

“Our wellness plan has been a great investment. Our dog gets regular check-ups, vaccinations, and dental cleanings, which has kept him healthy and happy. It’s a small monthly cost that has made a big difference in his overall well-being.” – Mary Jones

3-Stars:

“Pet insurance can be expensive, especially for older pets. Make sure to weigh the cost of premiums against the potential savings you may get in the event of a medical emergency.” – Cindy Williams

2-Stars:

“We had a bad experience with our pet insurance company. They denied our claim for a procedure that we thought was covered. Make sure to read the fine print carefully before signing up for a pet insurance policy.” – Thomas Brown

What’s New in Pet Insurance and Wellness

- Telemedicine for Pets: Telemedicine services are becoming increasingly popular for pet owners, providing convenient and affordable access to veterinarians.

- AI-Powered Health Monitoring: AI-powered wearable devices can track your pet’s activity levels, sleep patterns, and other vital signs, allowing you to detect potential health issues early on.

- Personalized Pet Care: Pet insurance companies are offering personalized plans tailored to the specific needs of each pet, based on factors such as breed, age, and lifestyle.

Conclusion

Pet insurance and wellness plans are valuable tools for maintaining the overall health and well-being of your furry friend. By understanding the different types of plans available, you can make informed decisions that provide financial protection and promote your pet’s longevity. Remember to consider your pet’s specific needs, your budget, and the benefits of preventative care when choosing the right plan. With the right coverage, you can ensure that your pet has the best possible chance of a healthy and happy life.

FAQs

Q: Is pet insurance worth the cost?

A: Whether pet insurance is worth the cost depends on your individual circumstances. However, it can provide peace of mind and financial protection in case of unexpected veterinary expenses.

Q: What is the difference between pet insurance and a wellness plan?

A: Pet insurance covers the costs of veterinary expenses, while wellness plans cover preventative care services such as check-ups, vaccinations, and dental cleanings.

Q: How do I choose the right pet insurance plan for my pet?

A: Consider your pet’s health, age, lifestyle, and budget when choosing a pet insurance plan.

Q: Are wellness plans a good value?

A: Wellness plans can be a good value by reducing the risk of costly treatments in the future and promoting your pet’s overall health.

Tables

| Pet Insurance Policy Type | Coverage | Pros | Cons |

|---|---|---|---|

| Accident-Only Policy | Injuries caused by accidents | Lower premiums | Limited coverage |

| Comprehensive Policy | Accidents, illnesses, surgeries, medications | More extensive coverage | Higher |