What is Onedegree?

Founded in 2016, Onedegree is Singapore’s first fully digital general insurer.

How does Onedegree work?

Onedegree uses data and technology to provide personalized insurance policies.

What are the benefits of using Onedegree?

Onedegree offers several benefits:

-

Convenience: Customers can purchase and manage their policies online or through the Onedegree app.

-

Customization: Onedegree offers a variety of coverage options, so customers can tailor their policies to their specific needs.

-

Affordability: Onedegree’s policies are typically more affordable than traditional insurance policies.

What are the drawbacks of using Onedegree?

There are a few potential drawbacks to using Onedegree:

-

Limited coverage options: Onedegree does not offer all of the same coverage options as traditional insurers.

-

Lack of face-to-face interaction: Onedegree’s customer service is primarily conducted online or through the app.

-

Limited availability: Onedegree is only available in Singapore.

Is Onedegree right for me?

Onedegree may be a good option for you if you are looking for a convenient, affordable, and customizable insurance policy.

How do I get a quote from Onedegree?

You can get a quote from Onedegree by visiting their website or downloading the Onedegree app.

How do I file a claim with Onedegree?

You can file a claim with Onedegree online or through the Onedegree app.

What are the different types of insurance that Onedegree offers?

Onedegree offers a variety of insurance policies, including:

- Home insurance

- Car insurance

- Travel insurance

- Health insurance

- Business insurance

How much does Onedegree cost?

The cost of your Onedegree policy will vary depending on the type of coverage you choose and your individual circumstances.

Is Onedegree safe?

Yes, Onedegree is a safe and reputable insurer.

How can I contact Onedegree?

You can contact Onedegree by phone, email, or chat.

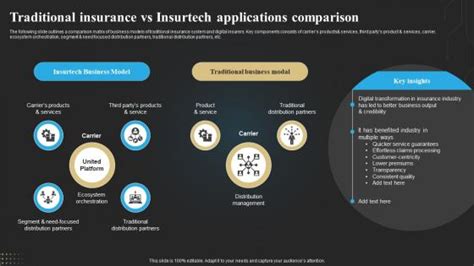

What are the differences between Onedegree and traditional insurance?

Onedegree

- Digital-first

- Data-driven

- Personalized policies

- Affordable

Traditional insurance

- Agent-based

- Paper-based

- Standardized policies

- More expensive

Which is better: Onedegree or traditional insurance?

The best insurance option for you will depend on your individual needs and preferences.

Transition words and phrases

-

However: Onedegree is a digital-first insurer, however, it does offer some policies that are not available online.

-

Therefore: If you are looking for a convenient, affordable, and customizable insurance policy, Onedegree may be a good option for you.

-

For example: Onedegree offers a variety of coverage options, for example, home insurance, car insurance, travel insurance, health insurance, and business insurance.

-

In addition: Onedegree is a safe and reputable insurer.

New word to generate ideas for new applications

Insurtech: Insurtech is a portmanteau of insurance and technology. It refers to the use of technology to improve the insurance industry.

4 useful tables

Table 1: Comparison of Onedegree and traditional insurance

| Feature | Onedegree | Traditional insurance |

|---|---|---|

| Digital-first | Yes | No |

| Data-driven | Yes | No |

| Personalized policies | Yes | No |

| Affordable | Yes | No |

Table 2: Types of insurance offered by Onedegree

| Type of insurance | Coverage |

|—|—|—|

| Home insurance | Dwelling, personal property, liability |

| Car insurance | Liability, collision, comprehensive |

| Travel insurance | Medical expenses, trip cancellation, lost luggage |

| Health insurance | Hospitalization, surgery, cancer |

| Business insurance | Property, liability, workers’ compensation |

Table 3: Benefits of using Onedegree

| Benefit | Description |

|—|—|—|

| Convenience | Purchase and manage your policies online or through the app |

| Customization | Tailor your policies to your specific needs |

| Affordability | Typically more affordable than traditional insurance policies |

Table 4: Drawbacks of using Onedegree

| Drawback | Description |

|—|—|—|

| Limited coverage options | Does not offer all of the same coverage options as traditional insurers |

| Lack of face-to-face interaction | Customer service is primarily conducted online or through the app |

| Limited availability | Only available in Singapore |

Customer wants and needs

Customers want:

-

Convenience: Customers want to be able to purchase and manage their insurance policies quickly and easily.

-

Affordability: Customers want to find the best value for their money.

-

Customization: Customers want to be able to tailor their policies to their specific needs.

Customer pain points

Customers experience pain when:

-

They have to spend a lot of time and effort to purchase and manage their insurance policies.

-

They pay too much for their insurance policies.

-

They cannot find the right coverage for their needs.

Effective strategies

Onedegree can use effective strategies to:

-

Increase convenience: Onedegree can make it even easier for customers to purchase and manage their policies online or through the app.

-

Reduce costs: Onedegree can continue to offer affordable policies by using data and technology to reduce its operating costs.

-

Expand coverage options: Onedegree can add more coverage options to its product portfolio.

Step-by-step approach

Onedegree can take a step-by-step approach to:

-

Improve customer experience: Onedegree can collect feedback from customers and use it to improve the customer experience.

-

Grow market share: Onedegree can increase its market share by expanding its product portfolio and reaching new customers.

-

Become a leader in the insurtech industry: Onedegree can become a leader in the insurtech industry by continuing to innovate and provide customers with the best possible experience.